When lending interest rates are high, homeowners considering a remodel are often caught in a dilemma: remodel now or wait for interest rates to drop. If you find yourself facing a similar choice, you’re not alone in your thinking. You want to improve your home, but you’re concerned that the costs might be more favorable if you wait for interest rates to go back down.

Our team at Lamont Bros. Design & Construction understands these financial concerns. We’ve consulted with many Portland area homeowners to help them navigate the financial issues relating to their home remodeling projects. Our goal is to educate homeowners so they can make informed decisions that align with their long-term goals and current financial realities.

In this article, we’ll discuss how you can navigate the remodeling process under the shadow of high interest rates. By drawing on industry expertise and past experiences, we’ll help you explore how to best approach the decision to remodel when interest rates are high. With this information, you’ll be able to decide whether or not now is the right time for you to renovate your home. The topics we’ll discuss include:

- How do High Interest Rates Affect Your Remodel?

- Comparing High Interest Rates to the Rising Cost of Remodel Construction

- Whether You Should Remodel Now or Wait Until Interest Rates Drop

How Do High Interest Rates Affect Your Remodel?

If you’ve watched the interest rates rise over the last few years, it’s completely reasonable to have concerns about how these numbers affect your remodel.

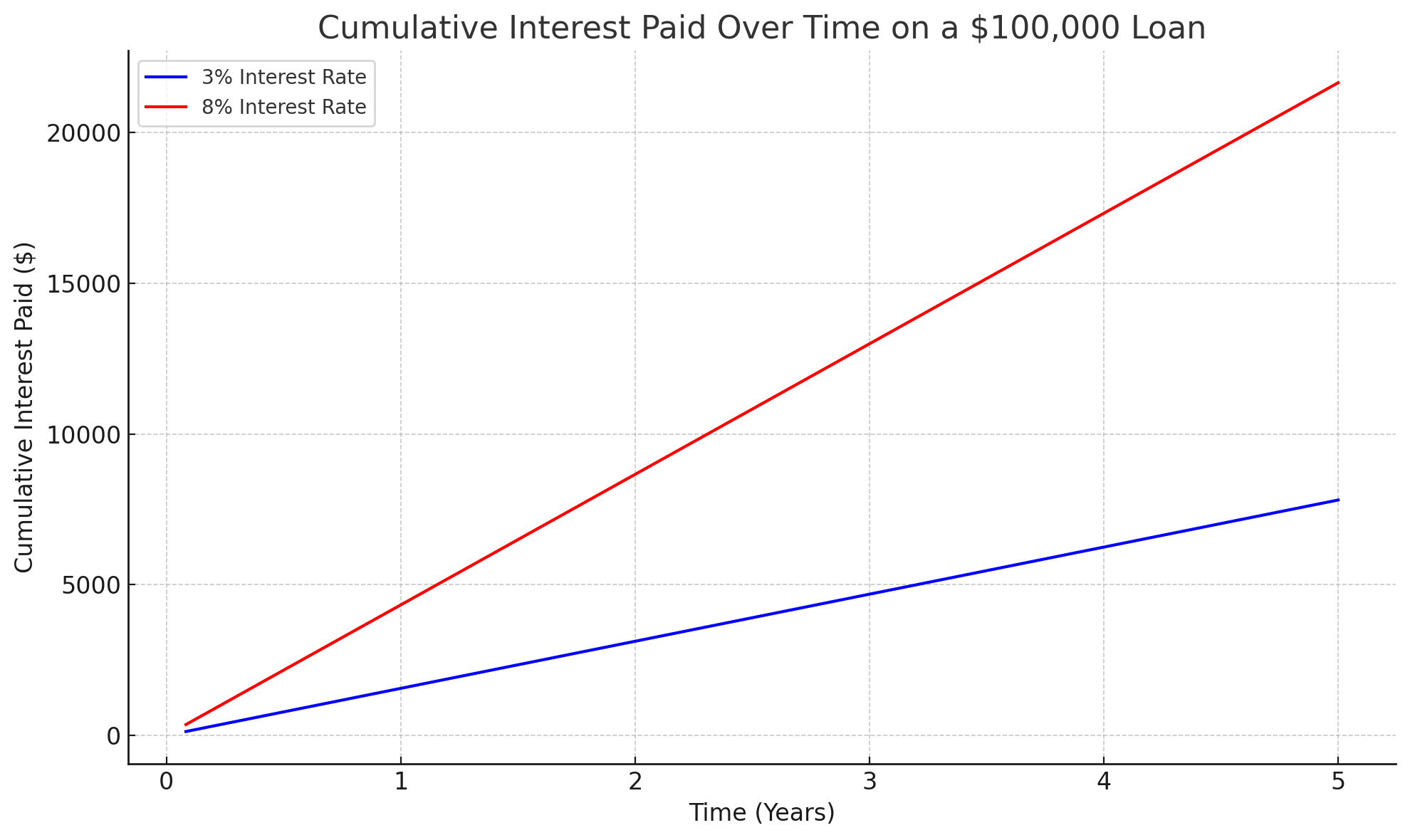

Let’s consider the cost of a $100,000 kitchen remodel. In 2021, interest rates were about 3%. By 2024, they had risen and stabilized at about 6.5%. Here’s how a 5-year renovation loan breaks down according to those two numbers:

Scenario 1: 3% Interest Rate (5-Year Loan)

Monthly Payment: Approximately $1,796.87

Total Cost Over the Life of the Loan (5 years): Approximately $107,812.14

Scenario 2: 8% Interest Rate (5-Year Loan)

Monthly Payment: Approximately $2,027.64

Total Cost Over the Life of the Loan (5 years): Approximately $121,658.37

What Difference Does the High Interest Rate Have?

These calculated figures for a loan term of 5 years show that, at a 3% interest rate, the total cost of the remodel over 5 years is about $107,812. However, at an 8% interest rate, it rises to around $121,658. That’s a total cost difference of $13,846.22, with a monthly cost difference of $230.77.

Clearly, homeowners have reason to be concerned about these high interest rates. It’s real money out of their pockets that they wouldn’t have had to pay 3 years prior for the same loan principal.

How Does Inflation Affect the Cost of Remodeling?

If interest rates were the only factor that affected the cost of remodeling, it would make sense to wait for them to come back down before beginning a home renovation. However, home improvement costs are subject to another major economic force: inflation.

Every year, remodeling costs increase by an average of about 5% (a conservative estimate based on historical data). Some years may be more, some may be less. From 2021 to 2022, costs rose by about 16%.

When it comes to construction, inflation is much more predictable than mortgage rates. In fact, out of the last 50 years, only two have seen a net drop in construction costs. Those two years aside, the average rate of increase sits at about 4.6% per year.

Inflation Statistics, 2018-2024

At Lamont Bros., we’ve spent the last several years tracking the increase in remodeling costs. Here are a few noteworthy findings.

The cost of labor increased by 50% from 2018 to 2024. That’s an average annual increase of 7% year over year. This is largely due to the mass labor shortages as the baby boomer generation moves towards retirement.

Construction material costs increased by 87% in the same amount of time. This makes the annual rate of inflation for materials even higher than labor, at 11% per year.

Here’s a great real-life example of the effects of inflation on product and material costs. Six years ago in 2018, the Kohler Workstation Sink was priced at $773. Today, the same exact sink sells for $1,599. Over six years, this sink more than doubled in cost. If you break that down, it’s an average annual increase of 12%.

Inflation vs. High Interest Rates

Now, you may be wondering, what does inflation have to do with high interest rates? The answer is, surprisingly, quite a bit.

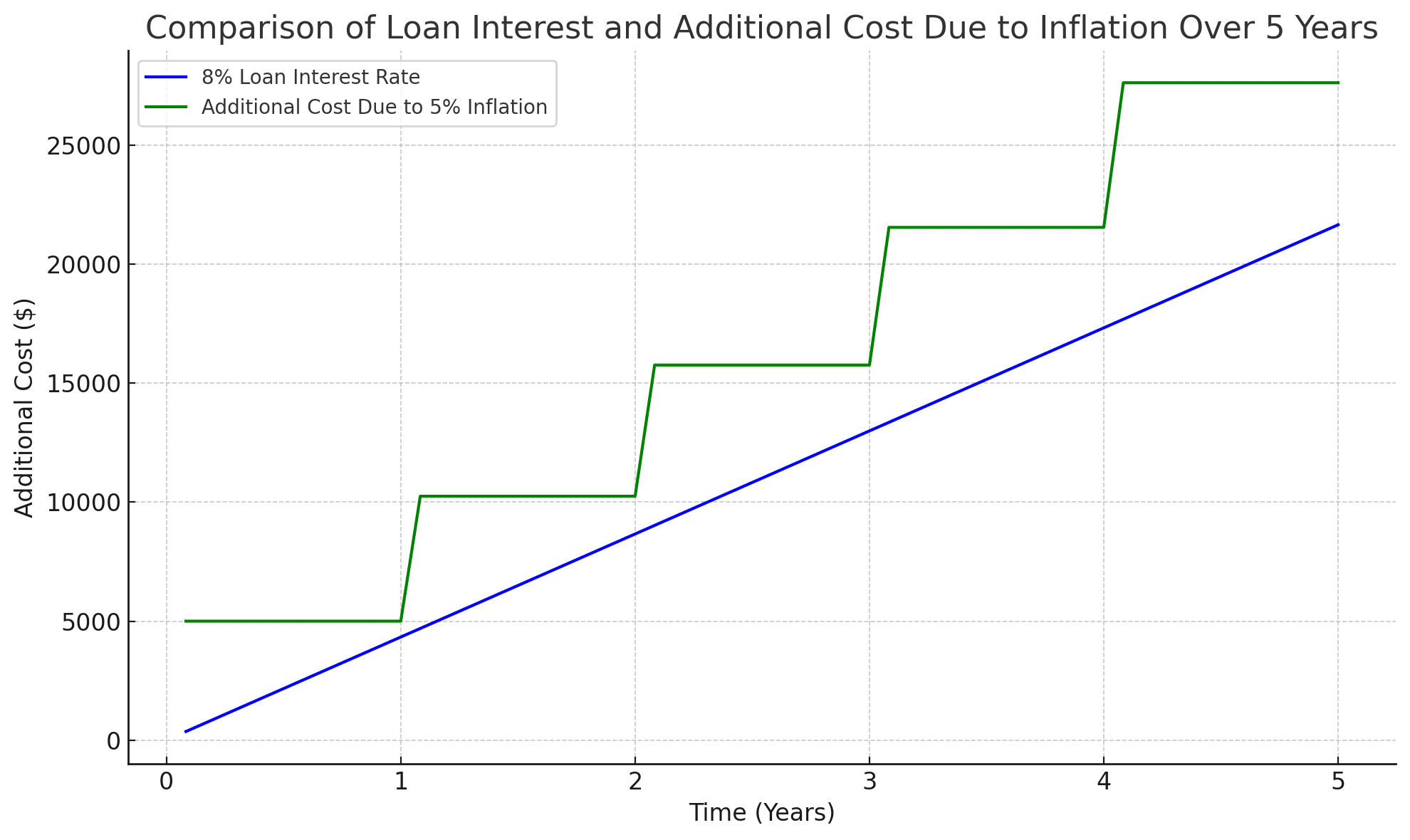

Let’s compare the cost of a $100,000 remodel with an 8% interest rate to the cost of paying in cash in 5 years.

Scenario 1: 8% Interest Rate (5-Year Loan)

Monthly Payment: Approximately $2,027.64

Total Cost Over the Life of the Loan (5 years): Approximately $121,658.37

Scenario 2: Cash Cost After 5 Years of Inflation

Annual Rate of Increase: 5% per year

Total Cost in 5 Years, Adjusted for Inflation: $127,628.16

Will You Save Money By Waiting?

Notice how after 5 years, the rate of inflation outpaces the 8% interest loan. In other words, it ends up being more expensive to wait 5 years and pay in cash than it does to remodel when interest rates are high.

And keep in mind, this doesn’t even account for potential refinancing opportunities in the future. You may have heard a realtor use the phrase, “Date the rate, marry the home.” The same is true for a remodel.

You can lock in a renovation at today’s prices with a high interest rate and refinance to a lower rate if they come down in the future. What you can’t do is get today’s remodeling prices 5 years from now when they’ve increased by over 25%.

Should I Remodel Now Or Wait?

Deciding whether to remodel now or wait is a nuanced decision, influenced by both current market conditions and individual financial circumstances. Let’s explore the reasons that might sway your decision in either direction.

Reasons to Remodel Now:

For homeowners concerned about high interest rates but wanting to invest in the quality of their living space, here are a few reasons you might consider pulling the trigger and remodeling now.

Your Project is a Long-Term Investment in the Comfort and Value of Your Home

If you’re living in a home that you plan to keep for a long time, remodeling now likely makes more sense. Due to inflation, your project will likely cost just as much later. The difference is that by remodeling now, you’ll have more time to enjoy your remodeled home.

Historical Data Showing Minimal Decreases in Home Remodeling Costs Over the Years

History shows us that remodeling costs rarely go down. This trend suggests that waiting for a dip in costs might be futile, and starting your remodel now could help you avoid higher costs in the future.

You Can Refinance the Loan When Rates Come Back Down

Although there’s no sure date when interest rates will return to normal, historic market cycles suggest that it will likely happen within the next few years. When rates do drop again, you’ll have the opportunity to refinance your loan. Remember, rates are temporary, but the principal is permanent.

Reasons to Wait:

Although remodeling with high interest rates still makes sense for many homeowners, there are a few specific scenarios where it might make sense to wait.

Potential for Better Financial Readiness or Improved Credit Score in the Future

If you expect your financial situation or credit score to improve in the next few years, waiting could be advantageous. Financial stability might open doors to better financing options, possibly canceling out the higher future costs of remodeling.

Anticipated Life Changes That Might Affect Remodeling Needs or Feasibility:

Life is unpredictable, and significant changes could alter your remodeling requirements. For example, perhaps you plan to retire, or your children will be away at college in a few years. If you expect life changes that might make it easier for you to live through a remodel, consider waiting.

Possibility For Future Low Interest Rates and Low Inflation in the Future:

While it’s exceedingly rare, certain economic conditions could lead to an imbalance where low interest rates coincide with low inflation. In such a case, lending rates would come down without a significant increase in construction costs. If you believe our economy is headed for such a rare scenario, then it might be worth waiting to see if your theory holds true.

Want to Learn More About Remodeling Financing?

Now that you understand more about how high interest rates affect the cost of remodeling, do you feel more confident in making decisions for your own remodeling project? As you develop a plan for your home improvement projects, continue expanding your knowledge. Download our free Remodel Funding Guide to learn about the different financing options available to you.

Ready to talk with a professional designer about your remodeling project? If so, click the button below to schedule a free consultation with a member of our design team. We’ll help answer any questions you have about remodeling and begin exploring how you can turn your current home into your dream home.